Virtual Data Rooms for Initial Public Offerings

Several tools can be used for handling private information. The virtual data room is one of the best pieces of software, which offers great IPO solutions.

Virtual data rooms software offers several IPO solutions at the same time. Initial Public Offering operation is a complicated business transaction that consists of processing a large amount of information and the subsequent presentation of the company to the market. Companies must be prepared to manage large amounts of data during the IPO process, ranging from financial audits by investors, auditors, and regulatory authorities up to long-term cooperation.

Online data rooms increasingly stimulate transactions for the investment banking community. VDR software became necessary in the M&A business; the growing IPO market will also need them because of the safety, efficiency, and economy that they provide.

What makes virtual data rooms so important for investment banking and managing IPOs? How can investment bankers use the VDRs during the IPO process?

Data room for IPO and due diligence management

An IPO, or Initial Public Offering, is the process whereby a privately held company issues and offers stock shares to public investors. At that time, the company’s stock will enter the stock exchange market for the first time. It’s a complex transaction that requires processing huge amounts of data to present the company to the market.

In a complex business transaction like an IPO, there are many parties involved. This is a long-term cooperation, which requires different financial audits done by all participants, such as investors, auditors, and legal representatives.

A virtual data room for initial public offering helps the processes to run effectively during the business operation, which provides many advantages to the investment banking community. A VDR offers security, efficiency, and economy while preparing an IPO.

Benefits of a virtual data room for IPOs

Meeting the security instructions and having security certifications

The virtual data rooms are trusted by many companies as they are compliant with many international security standards and certifications. The IPO process involves dealing with sensitive information, so security is the most important aspect in choosing the VDR provider.

Accordance with certifications like SOC 1, SOC 2, HIPAA, GDPR, ISO 27001, etc., guarantees that the provider offers high security of confidential data shared within the data room.

Making organization of documents easy

All of the necessary files and documents are stored in one place, which you can be fully managed in the dashboard. There are also data room features like indexing, which allow you to easily find needed files.

Creating IPO white papers

As a VDR user, you will not need to develop an IPO template for every new project. Some VDR providers have the white papers for an IPO, which may meet your needs, goals, and guidelines.

Making communication faster and better

As all of the needed information for the process is located in the data room, there is no need to use other communication tools. There is a Q&A section, where you can engage on certain questions. You can also leave comments and communicate with other users directly in the document you’re viewing. The history of changes in the documents, questions, and answers can be tracked as well.

Enabling different document permissions

Permission features in the VDR allow sharing of documents, but at the same time, restrict some of the parts in these documents. There are view-only options as well as other viewing restrictions that help to make sure that critical information is not leaked. There are also features like watermarking that prevent illegal copying and distribution of the shared documents.

Managing due diligence

This procedure demands managing a significant number of documents. That’s why having a secure space where you can share the files for audits is very important. Security features, like access levels, help to control who has permission to view the documentation and for how long.

Setting up integrations with other tools

In a VDR, you can integrate other tools, like Google Drive to easily get all of the needed files without doing any extra steps.

Managing daily work

Many features provide great space for effective task management. You can assign documents to different team members or other people involved in the process. Everything is monitored and managed through the intuitive dashboard, allowing you to see the progress to help eliminate duplicating any work.

Setting up audit trails

There are tracking and analytics features available in the data rooms. They allow you to see user activity and identify interaction levels with the documents. You can track if the investors have interest in some files and which documents they are checking the most. With tracking features, you can efficiently plan your IPO due diligence strategy.

Saving time

With the VDR, there is no need to keep everything in physical form and transport to different parties for review. It saves a lot of time and makes the IPO process faster. The IPO involves active communication between public firms, bankers, auditors, and others. And having the ability to manage everything in one place anytime helps to make all processes less time-consuming.

Creating a customized workspace

The VDR providers allow you to customize your working space according to the projects or transactions you’re managing. The potential shareholders that have access to the data room will see the organization of the processes from the level of preliminary verification.

Getting unlimited document access

The virtual data rooms allow 24/7 access, meaning you can manage projects that involve international shareholders or clients. You can access the documents anytime on any device that has access to the data room.

Saving costs

VDR providers offer several pricing options, so you can choose one that best suits your needs. Monthly plans vary depending on the number of projects, storage capacity, additional features, etc.

Getting professional support

Professional support will help you to structure your data room following your goals and needs. This way, you will use the virtual data room with maximum benefit and efficiency during the IPO process.

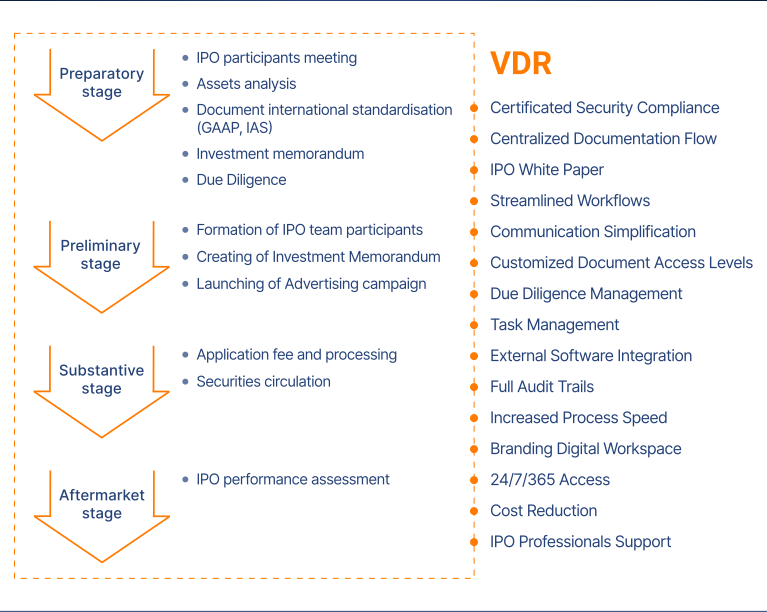

The initial public offering process using a VDR

An initial public offering, or IPO, arises when a firm decides to ‘go public’ and find funding for the growth of its operations. An IPO offers a great chance for the company to increase awareness about its brand and attract new potential investors.

The IPO process is time-consuming, it may take up to a year to prepare all of the needed documents plus additional time for marketing. Here are the four parts of the IPO process:

Preliminary IPO stage

At the beginning of the IPO process, it’s important to analyze the financial and economic situation, organizational and asset structure, and other business processes.

The preliminary stage begins before stock shares are offered to the public on a stock exchange. Here is what the company should complete during this stage:

- Meeting with all participants in the IPO process. All of the members of the working group that are involved in the IPO meet and discuss the processes. The participants of the meeting include owners, management, and top managers of the company, independent auditors, investment bankers and underwriters, as well as legal advisers and representatives of underwriters.

- Detailed analysis of the company’s assets. A preliminary analysis of the financial condition and asset structure helps to determine the current level of corporate governance quality, target parameters of the structure, cost of capital, and transparency of the company’s financial statements.

- Making documents compliant with international accounting standardization. Compiling financial documents that follow international standards, including GAAP and IAS.

- Due diligence process. Due diligence is the most time-consuming part you will face during an IPO. The procedure requires dealing with much paperwork, which should be filled out by the underwriters and the company. A comprehensive check of all financial activities of the company should be completed as well. The issuing company needs to register with the Securities and Exchange Commission (SEC), and then create the needed contracts between the company and the underwriter.

Preparatory IPO stage

Based on the results from the preliminary stage, the decision on an IPO is made, and the company is ready to move to the next point.

During the preparatory phase the company prepares for changes in different business operations and perspectives, including corporate governance, personnel, working capital, etc. During this stage, the new appointments may appear, as well as changes to corporate systems and structures.

The preparatory phase of the IPO consists of the following primary stages:

- Gathering of the IPO team. A team of IPO process participants is selected to develop an IPO implementation and configuration plan. The company usually appoints advisors that will help to better value the corporation and the raised capital.

- Investment memorandum. It’s a document with information that is essential for investors to come to a decision, such as setting the price per share, determining the number of shares to issue, the strategy for the use of funds, dividend policy, etc.

- Advertising campaign. The marketing documents also include the IPO prospectus. This file has all of the required information for investors. The success of attracting potential investors greatly depends on the quality of the advertising campaign. A promotion action plan can also be developed in a virtual data room, pre-setting access levels to users. The main task of the advertising campaign is to create hype surrounding a soon-to-be public company to boost the share price of the IPO and to provide the leading indicators of the company, the prospects, and the features of the share placement.

The IPO

During the IPO (stage), the actual collection of applications for the purchase of offered securities takes place. The company shares are priced based on the information available online, meaning this information has been revealed by the company, analysts, or any other shared data.

The main goal of the marketing phase during the IPO process is to get a market-derived valuation. Or at least get as close as possible to that value. Due to restricted disclosure requirements, financial planners do not share them.

The term “offer price” shows the price at which the issuer corporation obtains capital — so it’s crucial.

The final IPO stage

The final IPO stage is the beginning of the circulation of the securities and the transition to market competition.

After the IPO, there is a 25-day period, which is called the transition period. As it lapses, underwriters present estimates regarding the valuation and earning of the firm.

So, during the final IPO stage, the company analyzes the effectiveness of the IPO, develops the further strategy, and signs the agreements.

This process can be challenging and take up considerable time. There are many professionals, such as lawyers, investment bankers, and many others, who need to be involved and review the documents. That’s why having secure cloud storage for the files is critical for safe and quick cooperation.

For that reason, the IPO management teams choose the virtual data room for initial public offering to work on the complex processes.

Important features of Virtual Data Room for IPO using

- Certificated Security Compliance. An online data room is software that passes international data security certification. VDR suppliers guarantee high security of confidential data; VDR services are guaranteed by the presence of international security certificates and a non-disclosure agreement.

- Centralized Documentation Flow. All necessary documentation is located in one digital platform, which is fully regulated by the administrator of the data room software.

- IPO White Paper. Consumers of VDR do not need to develop an IPO template for each new project. Experienced VDR providers provide white papers for IPO according to your needs and goals, based on your own experience.

- Streamlined Workflows. The VDR platform is fully customized for ease of use for IPO: routine work processes are automated, saving resources and time. Cloud software improves user productivity and process efficiency.

- Communication Simplification. No need to use email or other communication software. Thus, you exclude conversations and letters. VDRs provide advanced Q&A features. This feature allows interested parties to discuss documentation within a single secure platform. Also, the entire history of questions and answers in the IPO process is preserved.

- Document Access Levels. VDR is a very flexible document management platform. The administrator can configure several levels of access to specific files. It is possible to create working groups that will have access only to a specific package of documents. A hierarchical system regulates the entire process of working with information.

- Due Diligence Management. Doing due diligence online is one of the essential functions of a digital data room. The responsible person uploads all the necessary documents to a safe space and sends out an invitation to access the VDR for the audit. Access levels and process participants can be changed at any time.

- Task Management. Ability to manage and monitor tasks from status and private entities. Convenient task management makes it possible to see the situation as a whole, control the progress of the process, eliminate unnecessary tasks, and avoid duplicates.

- External Software Integration. Sync from other sources. Integrate with popular tools like Google Drive to pull in information without any extra steps.

- Full Audit Trails. Tracking and analytics of user activity is another unique feature of VDR. User activity reports provide an opportunity to see the interest of potential investors, give companies an understanding of what their potential investors are looking at. Working with such data makes it possible to more carefully and efficiently plan an IPO due diligence strategy.

- Process Speed. The IPO process is an active communication of several participants in this process, for example, a public firm, bankers, lawyers, auditors, venture partners, and many others. VDR provides the ability to implement several processes at once in a virtual space with an intuitive interface. Also, access to the online data room platform for collaboration, which provides multi-level protection, can be carried out from anywhere in the world.

- Branding Digital Workspace. Opportunity to customize your VDR working space according to brand book. All potential shareholders will be immersed in the philosophy of your company at the level of preliminary verification.

- 24/7/365 access. Highly secure VDR dataroom allows for 24/7 access. Depends on VDR provider, you can manage your digital space using a mobile, tablet, or other devices with any operating system. VDR unsure access to files and documents at any time.

- Cost Reduction. Electronic data room providers offer several tariff plans for cloud services. Nevertheless, using the VDR data room is beneficial and less risky than using a physical data room or online file-sharing services.

- IPO Professionals Support. When you select a virtual data room provider for IPO, tech support is not only a tool for solving user issues. Technical support is involved in customizing the structure of your data room. Considering the purpose of using VDR, your personal manager will offer you a structure according to your needs for the maximum convenience of the Initial Public Offering process.